A time card allows you to have in order all the days and hours you have worked during a period of time. It essentially contains all the times when you started, paused, or stopped working. An online time card makes it easy for you to know how many hours you have worked in total and how much you should get paid based on the hourly rate you provide, if you choose to do so. It gives you the possibility to include overtime, breaks, to work with different time periods. With its simple and clean design the payroll hours calculator above makes it quick & easy to get the job done properly. Not only that, but not only subtractions can be made — additions can be made as well, for working overtime, or on the sixth or seventh day of the week.

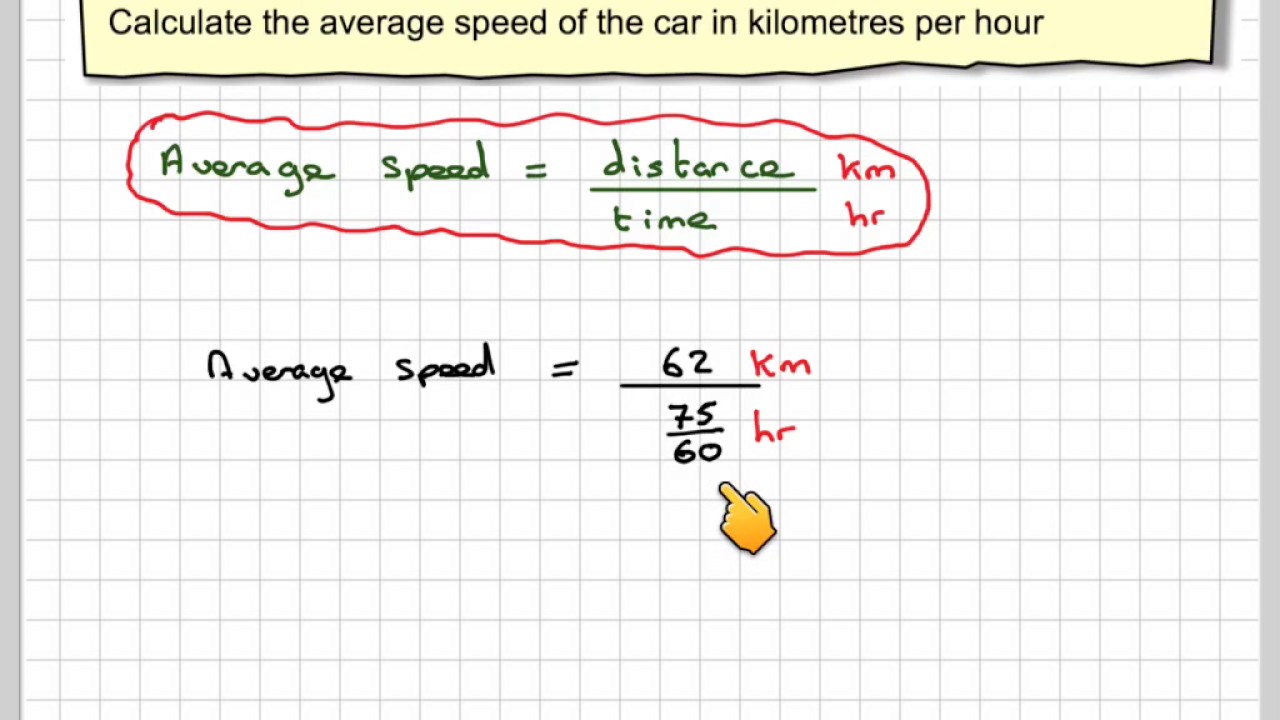

It is a fact of life that humans are unpredictable, but unfortunately, contracting officials get saddled with predicting their actions in order to draw up a reasonable contract. To determine your regular rate, divide the amount of your weekly salary by the number of hours worked during the week for which you are calculating your overtime pay. For instance, if your weekly salary is $500 and you worked 50 hours in one workweek, you would divide 500 by 50, giving you a regular rate of $10 per hour. You use this regular rate to calculate your overtime pay just as you would with an hourly rate. Your employer would owe you $10 per hour for the first 40 hours and $15 per hour for the 10 hours of overtime, for a total of $550. All the information you need is usually on employee timesheets or time cards.

These include the employee's pay rate, overtime rate, and information from the time clock. This is all you need to work out the total hours worked and even the amount to send through to payroll. Non-exempt employees are employees that are entitled to minimum wage as well as overtime pay under the FLSA.

Employers are also required to pay these workers an overtime rate of 1.5 times their standard rate when they work more than 40 hours per workweek. A non-exempt employee that is not paid overtime wages can file an FLSA overtime claim through the U.S. Most workers that are paid an hourly wage fall under this category. If your employees are required to work overtime on a public holiday as per S.60D of the Act, they are entitled to overtime pay of at least 3 days' wages at the ordinary rate of pay. This applies to all employees as per the act, including monthly, daily, and hourly-paid workers; the employees in question will also receive their ordinary pay, on top of the overtime pay.

Then just use the rows of fields to enter the start and end times and the total amount of breaks . If you get paid extra for overtime, select the corresponding overtime scheme and enter the pay rate ratio in the time sheet calculator. 1.5 overtime pay means that you get 50% higher hourly rate for overtime hours, compared to regular hours. If you are paid on an hourly or daily basis, the annual salary calculation does not apply to you. Your bi-weekly pay is calculated by multiplying your daily or hourly rate times the number of days or hours you are paid. The Fair Labor Standards Act, passed in 1938, guarantees employees compensation at one and a half times their regular rate for hours worked above 40 hours per week.

How overtime is calculated depends on whether the employee is paid hourly or by salary. Further, the calculation for salaried employees differs depending on the number of hours per week the salary is meant to compensate for. Time tracking with an online tracking software makes payroll processing a breeze, and Homebase time cards help you out by automatically identifying errors, including missed breaks or clock-outs. You can also compare your total hours to the scheduled hours instantly. Without the right time clock software, time tracking can be complicated and tricky.

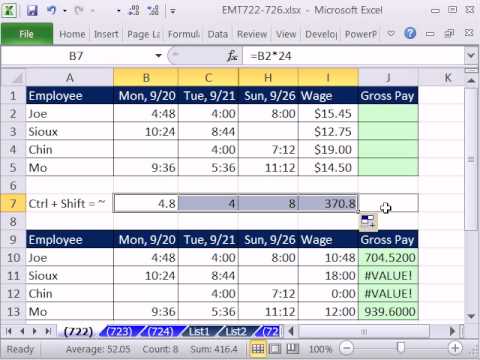

A timesheet calculator, also known as a time card calculator, is a tool that helps managers, business owners and employees by calculating the total number of hours worked for every staff member. For example, this free timecard calculator configures your weekly timecard hours for payroll and allows the manager or employee to include any break time used to ensure an accurate payroll period. OT Overtime The Time Card summary shows regular work hours and overtime hours. An employee who works more than 40 hours in a week must be paid 1.5 times their regular rate of pay for the excess hours. This applies even if an employee never works more than 8 hours in a day.

If an employee does work more than 8 hours in a day, only the first 8 hours worked each day are used to calculate total hours for weekly overtime. R Ltd's employee has been furloughed continuously since 1 May 2021. R Ltd makes a claim for 1 August 2021 to 31 August 2021. R Ltd has calculated that the minimum furlough pay for this period is £1,450, which is 80% of the employee's usual wages. An employer's employee has been furloughed continuously since 15 January 2021.

The employer makes a claim for 19 July 2021 to 25 July 2021. The employer has calculated that the minimum furlough pay for this period is £400, which is 80% of the employee's usual wages. R Ltd has calculated that the minimum furlough pay for this period is £1,500, which is 80% of the employee's usual wages.

U Ltd's employee has been furloughed continuously since 15 April 2020. U Ltd makes a claim for 1 November to 30 November 2020. U Ltd has calculated that the minimum furlough pay for this period is £1,500, which is 80% of the employee's usual wages. An employee is contracted to work 29 hours a week across four working days. The date they are paid is the last day of their pay period.

The employer looks to make a flexible furlough claim for the period 1 May 2021 to 14 May which is a whole pay period. The employer calculates the usual hours for this period. There are several ways and many programs available to help employers learn how to calculate employee hours worked or keep freelancers on track with how to add up work hours. But the most common way to clock hours for payroll is using your start and end time. From there, you can figure out how to calculate hours worked per day and then add them up to your total hours for your upcoming pay cycle. Employees are providing an average of two months of work to employersfor free every year.

Any employee who works in excess of 38 hours per week or 7.6 hours in a day must be paid overtime. Managers can discipline employees for not following company overtime policies – but business owners can't deny employees overtime pay. From the people at Calculator Soup, this free time card calculator keeps track of work hours, breaks and pay on a daily, weekly or monthly basis.

It allows multiple breaks per day and can auto-deduct breaks from your total hours worked. An employee working under an averaging agreement must be paid 2 times their regular rate of pay if he/she works more than 12 hours in a given day. The employee is entitled to 1.5 times their regular rate of pay for all hours worked in excess of an average of 40 hours per week over the period covered by the agreement. If in making these calculations you discover that your regular rate is less than minimum wage, your employer is in violation of minimum wage laws. For claim periods starting on or after 1 May 2021, the employer should not include the days where the employee was on statutory sick pay related leave, leaving 359 days.

The employer should also not include wages related to a period of statutory sick pay related leave – this was £1,250, leaving £21,750. For claim periods which end on or before 30 April 2021 the employer cannot remove these days or these amounts of wages from the calculation. An employee has a calendar month pay period and usually works 40 hours per week.

The employee was paid £2,000 in the last full monthly pay period before 19 March 2020. The employee is flexibly furloughed from 1 May 2021, working 10 hours per week. The flexible furlough agreement ends on 12 May 2021 and the employee returns to work their full usual hours from 13 May 2021.

Higher hourly rate for working during weekends or holidays is generally a matter of agreement between the employer and the employee. As long as total hours worked don't exceed 40 hours per week, pay rate isn't subject to federal or state laws . Calculating payroll and hours worked is simple but can be a hassle. You add up all the time an employee worked that week or month, convert time to decimal format, and multiply it by their hourly rate. Here's how you can automate the process and have payroll calculated in less than a minute.

This article reviewed a lot of options for tracking employee time. Department of Labor does not enforce how employers track employee hours, it does provide guidelines to track employee hours accurately. Regulations that state how long an employer must retrain payroll related data. Currently, employers are required to retain timecards and payroll related calculations for at least two years during and after employment. A complete list of wage-related information is located on the Department of Labor website dol.gov. There is an assortment of free online time card calculators on the internet.

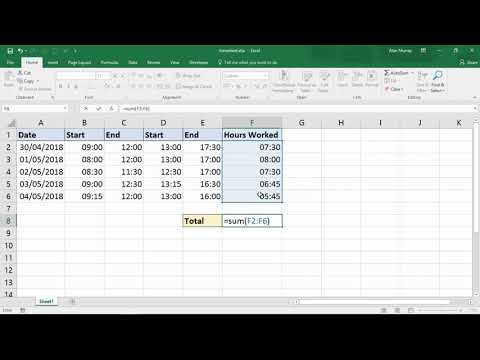

These time clock calculators handle the necessary calculations required to determined hours worked. Often, they function a lot like a spreadsheet, allowing you to fill in the information and it calculates total hours for you. Another option is using a free online work time calculator.

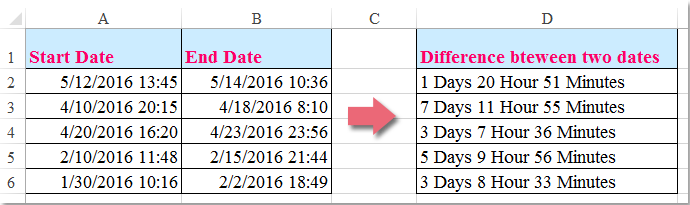

You just add the start and stop times for employees and confirm any breaks. The work time calculator then creates a spreadsheet with totals for your daily and weekly work hours. Although this solution is cost-effective, it can be very time-consuming having to enter all this data manually each day for each employee. The time clock calculator takes the total time between the starting and ending time and then deducts times when the employee is not working, such as a lunch break or driver rest time. The timesheet calculator can work out hours and minutes worked to produce the total hours worked between the starting and ending times. When calculating annual hours for salaried employees, the math will be slightly different.

Salaried workers receive checks weekly or bi-weekly, depending on the company. Those who are paid weekly should be covered for 40 hours, and those who are paid bi-weekly should be covered for 80 hours if that's a company's full-time policy. The employer must also be aware of holidays and vacation days and deduct those from the hours worked in the pay calculation. It's easy to calculate the number of work hours in an entire year by multiplying the number of hours in a workweek, times the number of weeks in the year. Forty hours a week worked times 52 weeks is 2,080 hours worked per year.

However, not every employee works a straight 40 hours – you'll have to add up their totals and multiply those by the number of weeks in a year to get the individual's annual total. When calculating annually for employees, make sure to take other factors into account as well. Most works usually have some holidays and vacation days, which you'll need to subtract from their total work hours.

While there are several tools to help employers calculate work time for employees, including apps, spreadsheets and online calculators, it's also good to know how to do so manually. Businesses pay employees per hour for work performed or on a salary basis. Employees paid by salary make the same amount every pay period, no matter how many hours worked. If they are terminated, you should be able to easily and quickly calculate their hours and those of your hourly employees. Employees can accurately track time via the software on various devices. Then the information from the timesheets is automatically synced into the payroll system.

You can automate the payments process by inputting the wage rates and setting the pay periods, which can be weekly, bi-weekly, monthly, or twice a month. Whichever method you choose — actual or rounded hours calculation — you have to keep in mind that if an employee has worked more than 40 hours per week, you are legally responsible for overtime pay. It's typically 1.5 times the regular wage rate per hour.

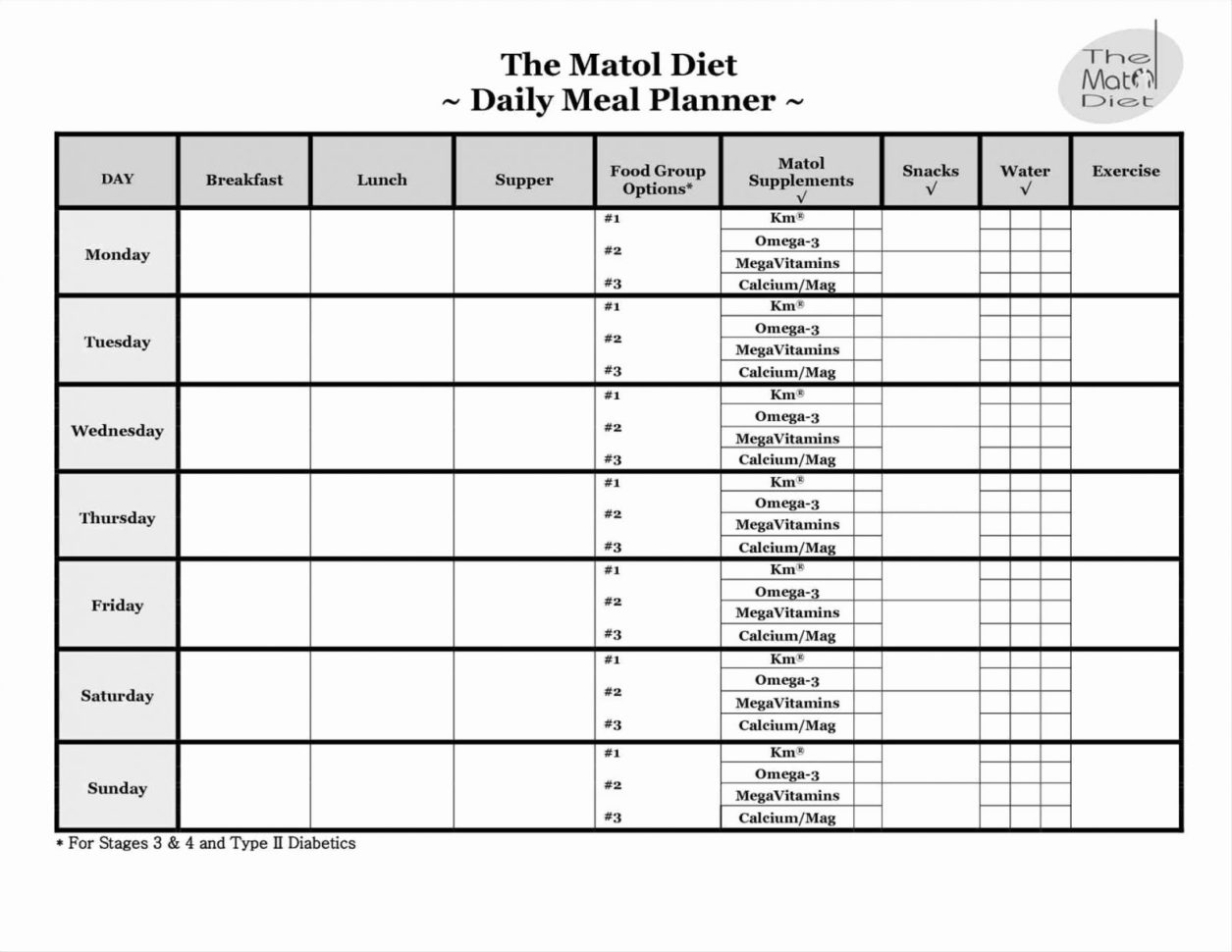

There may be other cases in which you need to use the overtime rate, such as weekend working hours or other special occasions. Perfect for freelancers, contractors and self employed workers. Set your working hours for each day of the week and instantly see your daily, weekly and monthly totals for hours worked and money earned. Add breaks and days off and they will be excluded from working hours calculations. Homebase makes managing hourly work easier for over 100,000 local businesses. Homebase works great for all hourly teams, including restaurants, retail, healthcare, home and repair, and professional services businesses.

Check out our about us page, read our blog, learn more about career opportunities, visit our press page, or read more about our coronavirus data. When you clock in or out, those times are automatically added to your time card, and at the end of the time, your time worked is calculated automatically based on your hourly rate. With the free Homebase mobile app, employees can also estimate their earnings for their hours worked. Employees can also use the mobile time clock in the app to clock in and out of your shifts. It's important to keep a record of clock ins and clock outs for all of your hourly employees so you can accurately calculate their work hours and minutes and gross pay. Using a time clock that integrates with timesheets is a much easier way to calculate hours worked and ensures all of the information is accurate.

T Ltd has calculated that the employee's usual hours from 1 July 2020 to 31 July 2020 are 164. The employee actually works 80 hours, and is therefore furloughed for the remaining 84 usual hours. T Ltd has calculated that 80% of the employee's usual wages is £1,800. The maximum wage amount is £2,500 as the claim is for a full month. This includes hours worked per day, clocking in and out times, breaks, overtime, wages paid, and other conditions of employment. Our time card calculator automatically tabulates all work hours and converts them to dollars and cents.

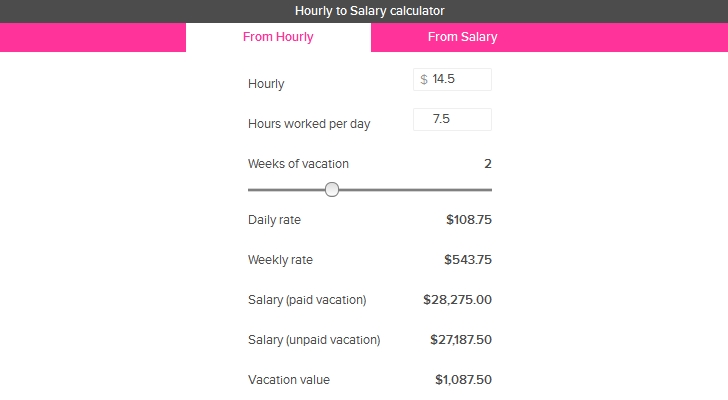

The calculator is totally electronic, ridding your business of those cumbersome and error-prone paper time card weekly and monthly reports that get bent, torn, or lost. After filling in any start or stop times for your employees enter in any lunch or break deductions. The free time card calculator will create a time sheet report with totals for your daily and weekly work hours. Use the calculator below to convert your annual salary, monthly, weekly, or daily wages into an hourly rate.

Overtime pay for piece work can be calculated in two ways. Your employer can pay you one and a half times the piece rate for each piece completed during overtime hours, or you can use the "regular rate" calculation to determine overtime pay by the hour. Workers can ask their employer for time off in lieu of payment of overtime hours. In such a case, the overtime rate (1.5) is applied, rather than the regular rate. To calculate the total number of hours of leave, each hour of overtime so converted is multiplied by one and one half. T Ltd's employee has been furloughed continuously since 1 May 2020.

From 1 July 2020, the employee returns to work part-time for T Ltd and is furloughed for the rest of their usual hours. T Ltd makes a flexible furlough claim for 1 July 2020 to 31 July 2020. Enter working hours for each day, optionally add breaks and working hours will be calculated automatically.

If you want to calculate total gross pay, enter hourly pay rate and choose overtime rate in format "1.5" for 150% overtime rate. Generally, the exemptions discussed above only apply to "white collar" employees. No matter how highly paid non-management employees in production, maintenance, or construction are, they are entitled to a minimum wage and overtime pay. This includes professions such as carpenters, electricians, mechanics, plumbers, ironworkers, craftsmen, and construction workers. Our employee time clock calculator automatically does time clock conversion from hours and minutes to decimal time. It can also calculate military time for payroll with the 24 hour military time clock setting.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.